If you want to sell/buy a business or have a portfolio of properties involved in an M&A, we recommend you start planning relating to the potential for environmental contamination affecting your sale or purchase value early. Environmental regulations require certain checks on the sale or purchase of a property. Where contamination is present, one time or ongoing remediation can be required.

Selling:

- Your environmental consultant will be able to identify or eliminate the presence of contamination. If required, we can outline a plan for controlling contamination and should be able to provide you with a fully costed environmental program (a cost range can be produced for later stage items that will narrow as the investigation process progresses). This should be sufficient to provide your board with a cost-benefit analysis. If your environmental consultant cannot provide a plan and costing, then this may indicate inexperience.

- It is always better to understand 'the devil you know'. Doing the environmental investigation and sampling required to work out if there is a problem, how big it is is where we come in. There is a wide range of management strategies that might align with your business strategy and sale price. Our knowledge will enable you to keep driving the process so you can control it.

- Negotiations around price and liability in property/business transactions are common in the presence or suspicion of contamination. Getting good advice from an experienced environmental consultant is essential. We can also act as a strong negotiator on your behalf.

- Be careful about unknown contamination liability coming back to your board of directors, even after sale and close of a business (by legislation in most states in Australia this is possible and relatively common). It is better to have all contamination assessed and at least agreement of management and disclosure prior to sale.

- The laws differ between the states of Australia, so be sure to engage work with consultants that regularly work in your state.

- Ongoing regulatory compliance issues can be resolved to a level that increases your property value but doesn't strip you of operational profit.

Buying:

- Prior to sale, it is essential you do your due diligence by asking for any environmental reports and having a consultant review them. Some investigation reports are very limited in scope and may leave substantial risks.

- Have a Preliminary Site Investigation (PSI) completed checking all the historical contamination at a property prior to the final sale value. This can, at a minimum, determine if there are any BIG contamination problems and the potential scale of them.

- Make sure your lawyer or negotiator knows what is required by environmental law to be handed over at sale. This includes known information related to known or potential contamination and contaminating activities.

- Have an environmental consultant estimate any environmental liability. You can also use this as a tool for negotiation in purchase value, or other contentious items in negotiations. Contamination can be tricky, it is often misunderstood, and can be a significant portion of the cost of purchase of a business or property (and sometimes much greater in cost).

- A contaminated property may not require remediation to be used for a specific purpose, but contamination will still devalue the property asset value regardless. This financial risk is different from any contamination liability itself and may affect the future value of a property.

- If you plan to purchase and/or lease a property, make sure that at the start of the lease the subsurface / environmental condition is assessed to form a baseline going forward. The lessee then will have a benchmark condition to return the site to at the end of the lease. Negotiations may include the transfer of leases and the environmental condition of the site can be a key important issue to get right during the negotiation period. A baseline investigation might be your best friend.

- Remember the vendor business may honestly not know about or be aware of existing or pre-existing (prior to purchase) environmental contamination hidden beneath the ground. It is common to not know the extent of contamination or condition of the subsurface. The unknowns can cause a surprising and very significant liability and potential regulatory risk. Any environmental report provided needs a review of the scope, data gaps, quality controls and overall report and investigation quality.

- Be aware a report showing the site is 'clean' may be deceptive and limited in scope.

- If you or your financier want reliance (PI insurance coverage) on an environmental report provided by the other party after purchase or during the purchase process, ask for a letter offering reliance of the report to the new party(ies) from the author. A fee transaction for doing this is required to transfer insurance (often several thousand dollars is quoted).

Next Steps:

RECENT PPRPERTY PROJECTS

The Business Benefits of Environmental Integrity and Sustainability

Financial Benefits of Environmental Integrity and Sustainability Environmental integrity and sustainability yield significant business advantages. Unlock the secret to boosting...

Decoding Detailed Site Investigations: What Businesses Need to Know

Unraveling the Mysteries of Detailed Site Investigations Understanding Detailed Site Investigations (DSIs) is essential for businesses navigating environmental compliance, especially...

Where Does All the Soil Go?

You see lots of building developments going up, and large construction sites. When developers clear the site and make the...

Former Oyster Farm Investigation for Residential Development

iEnvi was engaged by the client to complete a Targeted Soil Assessment relating the footprint of a shed previously located...

Selling or buying a business (M&A)? Understand the hidden environmental contamination risks

If you want to sell/buy a business or have a portfolio of properties involved in an M&A, we recommend you...

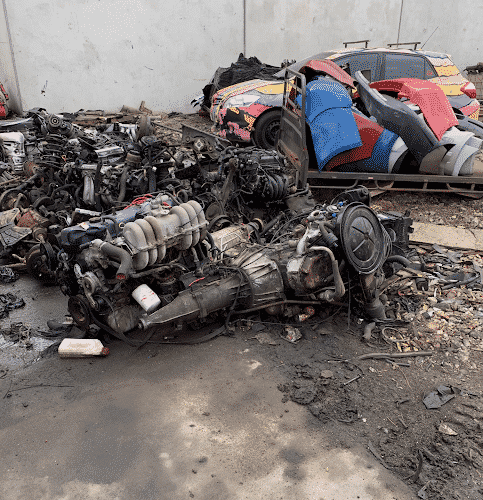

Underground Petroleum Storage System

It is relatively common to have underground petroleum tanks on industrial or light industrial sites, due to historical business activities (such...

Site and Environmental Management Plan of a Metal Recycling Facility

iEnvi was engaged by a metal recycling facility to complete a Site and Environmental Management Plan (SEMP), also known as...

Construction Environmental Management for Service Station

iEnvi was engaged by a development construction company to prepare a construction environmental management plan (CEMP) for a service station...

Panel Beating an Operational Environmental Management Plan

iEnvi was engaged by a panel beating company to complete an Operational Environmental Management Plan (OEMP) to meet the requirement...

Granny's Acid Sulfate Soil Management

iEnvi was engaged by a client to complete an acid sulfate soil management plan (ASSMP) of a residential property in...

Construction Environmental Management Plan, Western NSW

iEnvi was engaged by a development company to complete a Construction Environmental Management Plan (CEMP) for a fast food restaurant...

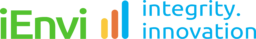

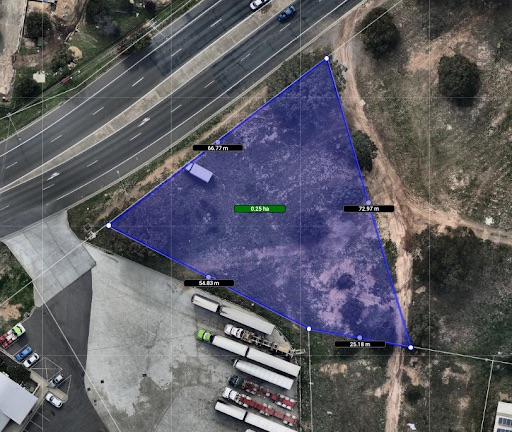

Preliminary Site Investigation at Auto Recycler for Refinancing, Melbourne Victoria

iEnvi was engaged by an automotive recycling company to undertake a preliminary site investigation at a recycling facility in Melbourne,...

UPSS Abandonment Insitu Via Foam Filling, Sunshine Coast QLD

iEnvi was engaged by a local restaurant owner to manage the decommissioning and abandonment of three underground storage tanks (USTs)...

Construction Environmental Management Plan for a Sports Complex, South East QLD

iEnvi were engaged by an engineering firm on behalf of a regional council to undertake a Construction Environmental Management Plan...

Contaminated Property Problems!!

Contaminated properties are rarely understood by businesses, and always a significant problem for businesses to manage. They can also be...

Erosion Sediment Control Plan (ESCP), Mornington Peninsula, VIC

Envi was engaged by a construction company to review and update the erosion sediment control plan (ESCP) as part of...

Urgent Preliminary Site Investigations for M&A, Multiple Sites QLD, NSW, SA

iEnvi was engaged by a law firm on behalf of a confidential client as part of merger and acquisition...

Preliminary Site Investigations for Potential Acquisition, VIC and WA

iEnvi was engaged by an international manufacturing company to undertake preliminary site investigations at two coatings manufacturing facilities in Victoria...

Law firm engagement for Preliminary and Detailed Site Investigation of Former Service Station, Inner Sydney NSW

iEnvi was engaged by a law firm to complete a preliminary site investigation (PSI) and underground petroleum storage system (UPSS)...

Preliminary Site Investigation of a mechanic workshop for finance approval, Wynnum QLD

iEnvi was engaged by a private company wishing to purchase a mechanic workshop in Wynnum, Queensland and a preliminary site...

Soil Investigation and Potential Soil Reuse, Brisbane QLD

iEnvi was engaged by a childcare centre development company to undertake soil sampling at a residential site prior to the...

Housing Development Application, Sydney NSW

iEnvi was engaged by a client to undertake a preliminary site investigation and soil sampling (PSI) at a property in...

Nepali Place of Worship Development Application, North Western Sydney, NSW

iEnvi was engaged by a client to undertake a preliminary site investigation and soil sampling (PSI) at a property in...

Preliminary Site Investigation for Child Care Centre - Sydney Northern Beaches

iEnvironmental Australia (iEnvi) was recently engaged by an architect firm to conduct a preliminary site investigation on a property they...